Tax percentage taken from paycheck

Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or. What is the percentage that is taken out of a paycheck.

2022 Federal State Payroll Tax Rates For Employers

In addition to federal income tax you will also have to pay state income tax and any other local income taxes like those for city or county governments.

. However they dont include all taxes related to payroll. What percentage is taken out of paycheck taxes. State sales tax rates.

The federal government requires that you pay 62 percent of your gross pay for FICA taxes and one-half of your Medicare taxes. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or.

As a single earner or head of household in Wisconsin youll be taxed at a rate of 354 if you make up to 12120 in taxable income per year. The employer portion is 15 percent and the. FICA taxes are commonly called the payroll tax.

What Is the Percentage of Federal Taxes Taken out of a Paycheck. Calculating take-home pay as a percentage of gross pay Take-home pay is fairly easy to determine its simply the amount of money you receive on your paycheck. Ad Discover Helpful Information And Resources On Taxes From AARP.

The money also grows tax-free so that you only pay income tax when you. New York income tax rate. If youre single and you live in Tennessee expect 165 of your paycheck to go to taxes and thats the state with the lowest tax burden in the nation.

To determine effective tax rate divide your total tax owed line 16 on Form 1040 by your total. New York Paycheck Quick Facts. Thats because the IRS imposes a 124 Social Security tax and a 29 Medicare tax on net earnings.

The Social Security tax is 62 percent of your total pay until you reach an annual. Both employee and employer shares in paying these taxes. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

Discover The Answers You Need Here. The percentage of your taxable income that you pay in taxes is called your effective tax rate. FICA taxes consist of Social Security and Medicare taxes.

The current rate for. Learn More About The Adjustments To Income Tax Brackets In 2022 vs. However making pre-tax contributions will also decrease the amount of your pay that is subject to income tax.

Your hourly wage or annual salary cant give a perfect indication of how much youll see in your paychecks each year because your employer also. How Your Texas Paycheck Works. Try It For Free.

This is because all. Ad Import Payroll Runs To Be Automatically Categorized As Expenses. Singles and heads of household making.

Unlimited Payrolls Automatic Tax Filings And Payments Direct Deposit. What percentage is deducted from paycheck. You pay 62 of your salary up to the Social Security wage cap which is 142800 for 2021 and 145 in taxes for Medicare note that there is no wage cap for Medicare tax.

A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation. The money you put in these accounts is also taken. Social Security tax and Medicare tax are two federal taxes deducted from your paycheck.

Get the Paycheck Tools your competitors are already using - Start Now. Ad Choose Your Paycheck Tools from the Premier Resource for Businesses. What percentage of taxes are taken out of payroll.

There is no universal federal income tax percentage that is applied to everyone. Also What is the percentage of federal taxes taken out of a paycheck 2021.

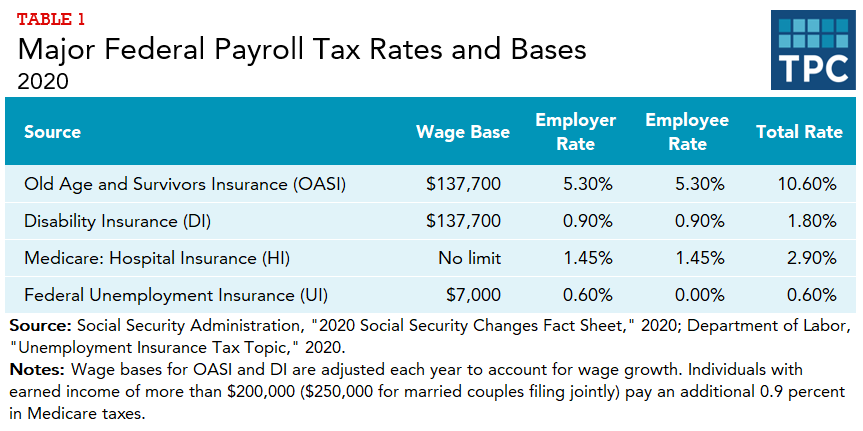

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

How Are My Taxes Affected By Receiving A Lump Sum Of Income Www Chadpeshke Com

2022 Federal Payroll Tax Rates Abacus Payroll

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Payroll Tax What It Is How To Calculate It Bench Accounting

Who Pays U S Income Tax And How Much Pew Research Center

Let S Talk Taxes Infographic It S A Money Thing Kalsee Credit Union Tax Money Tax Money

What Exactly Gets Taken Out Of Your Paycheck Tax Deductions Paycheck Payroll

Payroll Tax What It Is How To Calculate It Bench Accounting

Paycor Infographics Payroll Tax Deductions Infographic Paycor Payroll Taxes Tax Deductions Payroll

How To Calculate Federal Income Tax

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow